A Tale of Two Markets: One Followed the Rules, One Rewrote Them

An unregulated prediction market just demonstrated exactly why the CFTC exists

Both Kalshi and Polymarket had versions of this mention market. What happened next is an interesting case of regulated vs. un-regulated markets.

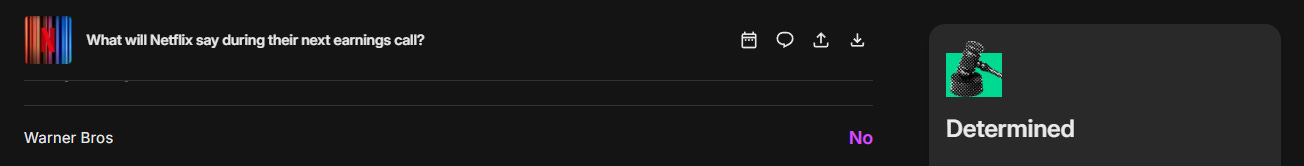

Kalshi, a CFTC-regulated exchange, resolved based on the rules as written.

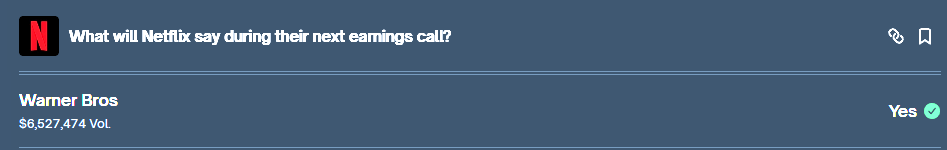

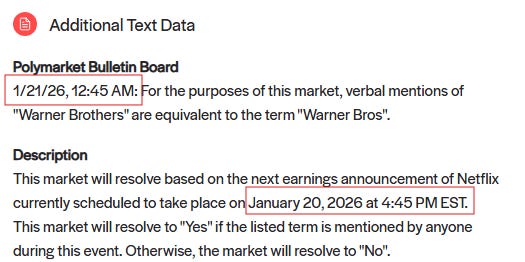

Polymarket, an unregulated exchange changed the rules after the event was over, then resolved said event to YES.

This of course, has left Polymarket traders absolutely livid—

But, how?

On Kalshi, the rules were clear from the start. “Bros” meant “Bros.” The speakers on the call said “Brothers.” The textual interpretation was straightforward, even if some traders disagreed with it. The market resolved according to the written criteria that existed when traders entered their positions.

On Polymarket, the outcome was less certain—so they simply made it certain. After the event concluded, the resolution source was amended to treat “Warner Brothers” and “Warner Bros” as equivalent. After almost three days of back-and-forth disputes—the market resolved to YES.

The CFTC Exists for This Exact Reason

I don’t want to seem like I’m overtly praising CFTC. But let’s be clear about what the CFTC’s oversight of Kalshi actually provides:

Immutability: Contract terms are filed with the CFTC and cannot be changed post-issuance on a whim.

Transparency: Resolution criteria must be documented and applied in a uniform manner.

Recourse: Traders have a regulatory body and the National Futures Assoc. to appeal to if an exchange behaves improperly.

Regulatory Accountability: Kalshi can’t just decide who wins after the fact.

Polymarket operates offshore, and outside CFTC jurisdiction. There’s no filing requirement. There’s no regulatory oversight. There’s no appeals process beyond hoping the UMA oracle or Polymarket’s team rules in your favor.

When the rules are whatever Polymarket says they are—and whenever they want to say it—it adds risk to traders.

But isn’t Polymarket Decentralized?

Yes, settlement technically runs through UMA’s oracle system. But when Polymarket itself amends the resolution criteria fed to that oracle, “decentralization” is just theater. The oracle resolves based on inputs. Polymarket controls the inputs.

Decentralized infrastructure executing centralized decisions is just centralization with extra steps.

The Precedent Problem

Polymarket’s has now set the precedence:

The rules are suggestions. We can change them if the outcome feels wrong to us.

How do you price a contract when the strike price can move after expiration?

For small retail traders, this might not matter much. For anyone trying to run a serious strategy, deploy real capital, or build systematic approaches to prediction markets, Polymarket just revealed itself as unacceptably risky not because of market risk, but because of platform risk.

This is a rare case, where regulators ended up being cheered by traders.

Disclaimer

This article is for informational and educational purposes only and does not constitute investment advice, trading advice, or a recommendation to buy, sell, or hold any position in any event contract or financial instrument. Event contracts involve risk, including the potential loss of your entire investment. Past performance is not indicative of future results.

The author may hold positions in contracts discussed on various prediction market platforms. Contract interpretation and regulatory analysis is opinion only. The author is not providing Commodity Trading Advice (CTA) by publishing this article. Readers should conduct their own research and consult with a qualified financial advisor before making any trading decisions.

Great read! I remember laughing abt the Time Person of the Year thing on Kalshi a few weeks ago but I didn't appreciate the linkage to the CFTC at the time. Would love to read more abt where you think these marketplaces should and shouldn't be regulated in the future