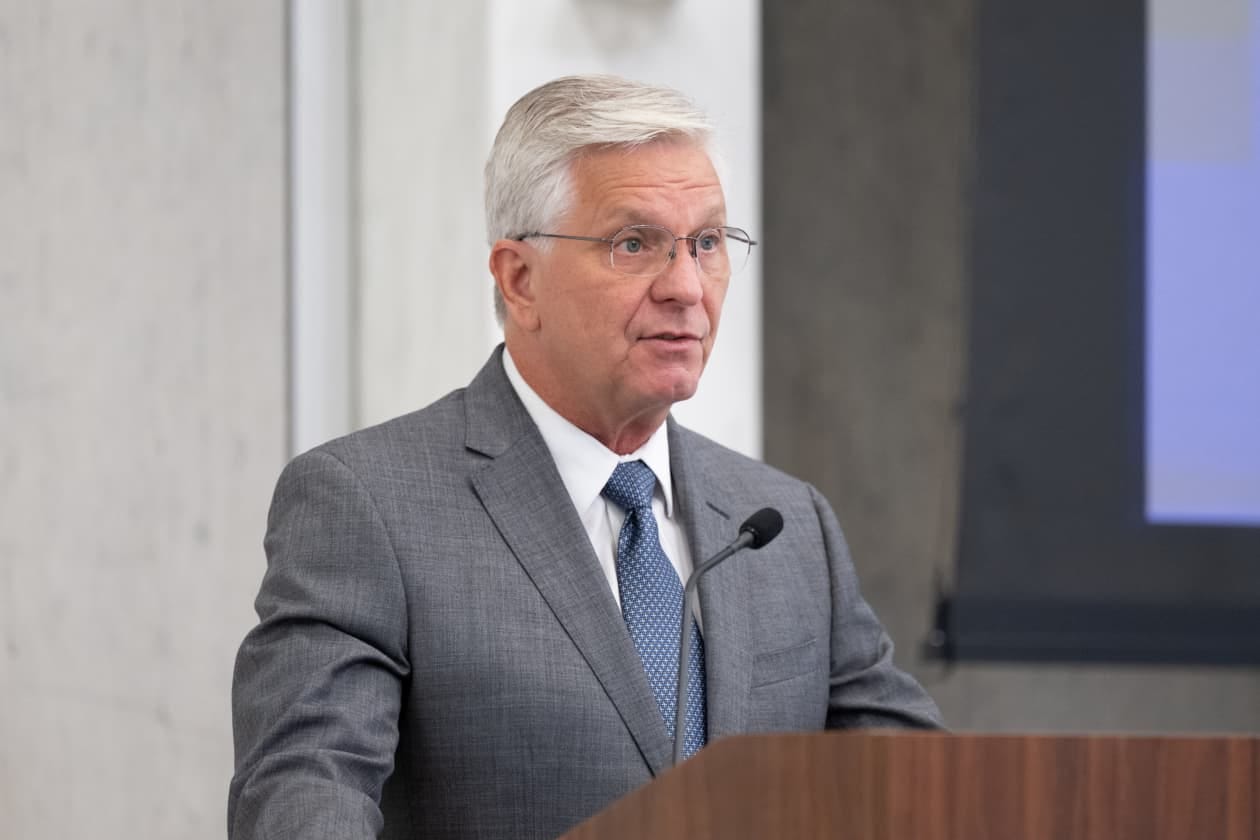

Christopher Waller for Fed Chair?

If Trump wants lower rates and Fed credibility, all roads lead to Waller.

President Trump is slated to announce his selection for Federal Reserve Chair as soon as next week. Prediction markets currently price Christopher Waller at just 11.5-13%—a distant fourth behind Kevin Warsh (51%), Rick Rieder (28%), and Kevin Hassett (5%).

Based on our examination of confirmation mechanics, competitors, and structural factors, our analysis concludes that Waller’s true probability sits closer to 22%

Which is nearly double his current market price. We will also provide a bull case that Christopher Waller may be the next Fed Chair given the current socio-economic-political environment. Paid subscribers will have access to our early warning intelligence signals at the end of the article!

Current State of Play

Treasury Secretary Scott Bessent confirmed on January 21, 2026 that Trump has narrowed the field to three finalists.

These odds reflect public perception of Trump’s statements rather than genuine insider intelligence. The race experienced dramatic volatility after Trump’s January 16 comment about wanting to “keep Hassett where he is”—a 26-point sell-off.

As expected markets are reacting to public signals, not tangible “inside the White House” information.

Waller’s Profile

Christopher Waller brings a unique combination of Trump loyalty, academic credibility, and institutional knowledge.

Credentials:

Current Fed Governor since December 2020 (term through January 2030)

Research Director, Federal Reserve Bank of St. Louis (2009-2020)

Ph.D. Economics, Washington State University

100+ peer-reviewed publications on monetary theory and central bank policy

2020 Confirmation: Waller was confirmed 48-47 with five Democratic senators crossing party lines. This is a proven track record of bipartisan ability for confirmation.

December 2025 White House Interview: President Trump conducted several in-person interviews with his short list. Waller was described by two senior officials as having a “strong interview.” It is believed his interview was predominately focused on the labor market and job creation strategies. During this interview President Trump was flanked by Treasury Sec. Bessent, Susie Wiles, and Dan Scavino his Chief of Staff and Deputy Chief of Staff, respectively.

The Case for Waller

1. Senate Math

All roads lead to a 13-11 Republican majority on the Senate Banking Committee.

However —

Senator Thom Tillis (R-NC) publicly declared on January 12 that he will oppose any Fed nominee until the DOJ’s criminal investigation into Powell is resolved. The important keyword to remember here is: ANY.

With Tillis voting no, the committee splits 12-12—blocking any nomination from advancing.

Waller has a unique advantage: Among the four finalists, only Waller has demonstrated bipartisan confirmability. If the DOJ matter involving Powell is not resolved, we expect trump to select the candidate most likely to pass when the window opens.

That candidate is Waller.

2. The Larry Summers Victory

When the Fed began aggressive rate hikes, Larry Summers argued unemployment would need to rise to 6%+ to bring inflation down—implying roughly 4 million job losses. Waller countered with Beveridge Curve analysis suggesting inflation could fall without mass layoffs.

Subsequently—Inflation dropped from 8%+ to near 2%. Unemployment remained below 4%. Waller was correct; Summers was wrong.

Trump overwhelmingly values: economic policy elites (Waller outperformed a Harvard economist) and Trump also wants to be able to take credit for a soft landing and strong job market.

3. The Policy Alignment

Throughout 2025, Waller executed a strategic dovish pivot:

July 2025: Dissented when FOMC held rates steady, arguing for a 25 basis point cut

November 2025: Made “The Case for Continuing Rate Cuts” in London, citing labor market concerns

What Waller posits is directly aligned with Trump’s routinely public calls for “lower interest rates”

Competitor Vulnerabilities

Kevin Warsh (51% Odds)

The Estée Lauder Problem: Warsh married Jane Lauder, granddaughter of Estée Lauder’s founder. His father-in-law Ronald Lauder is a Trump ally who planted the Greenland annexation idea. This connection provides access but creates a nepotism narrative that Senate Democrats will exploit.

Policy Inconsistency: Warsh resigned from the Fed in 2011 after opposing QE2, warning about inflation risks from monetary expansion. His current advocacy for aggressive rate cuts represents a complete reversal that confirmation hearings will expose.

The Morgan Stanley Conflict: Warsh worked at Morgan Stanley 1995-2002. During the 2008 crisis, as Fed Governor, he negotiated Morgan Stanley’s conversion to bank holding company status to access Fed emergency lending—a potential conflict that generates negative headlines.

Rick Rieder (28% Odds)

We believe Rieder’s odds are vastly over estimated—Rieder has never held a federal position, testified before Congress, or navigated Senate confirmation.

Rieder was head of Lehman’s Global Principal Strategies team (proprietary trading) until the September 2008 bankruptcy. Democrats will likely grill him on his involvement in this.

Kevin Hassett (5% Odds)

Hassett’s odds crated when Trump’s January 16 statement appeared to eliminate Hassett, though his “I want to keep you where you are.”

Five Scenarios Where Waller Wins

Scenario 1: Confirmability Crisis (20-25% probability) Warsh and Rieder hit serious confirmation turbulence. Bessent and Wiles argue Waller is the only candidate with proven bipartisan support.

Scenario 2: Labor Market Narrative (15-20%) Weak January/February jobs data shifts Trump’s framing from “Fed Chair who cuts rates” to “Fed Chair who protects jobs.” Waller’s soft landing prediction provides credibility.

Scenario 3: Powell Stay-On (25-30%) Powell announces he’ll remain as Governor through January 2028. Waller’s working relationship with Powell (both dissented in July 2025) provides operational compatibility other candidates lack.

Scenario 4: The Tillis Trade (15-20%) Tillis negotiates: he drops the blockade if Trump withdraws the Powell investigation and nominates a genuinely independent Chair. Waller’s “absolutely” defense of Fed independence provides Tillis cover.

Scenario 5: Bessent Advocacy (10-15%) Treasury Secretary privately pushes Waller as optimal for confirmability, competence, and dovish policy. Bessent’s market credibility gives him unique influence over Trump’s decision.

The Bear Case

Despite structural strengths, Waller faces headwinds:

Trump historically prioritizes personal relationships and media presence over technocratic competence

Waller’s December 17 statement that he would “absolutely” defend Fed independence may have been disqualifying

Sustained 12% odds despite his December interview suggest insiders know he’s not Trump’s choice

At 67 in 2026, Waller may be seen as too old for a decade-shaping appointment

The Contrarian Position:

We believe Waller at 12% represents significant value. A $1,000 bet returns $8,300 if he wins.

Please bear in mind— the above statement is governed via our Terms

🔒 Early Warning Indicators (Paid Subscribers Only) 🔒

The following intelligence collection priorities and early warning signals are available to paid subscribers. These indicators may provide 24-72 hours advance notice of the selection before public announcement.