Mastering Event Contracts: Finding Alpha on this New Frontier.

You have a unique chance to be a cash pioneer trading event contracts.

Let us rewind the clock to 1792, where only about 12 brokers in New York gathered to trade a small basket of stocks/securities at what would later become the New York Stock Exchange. Information back then moved at a literal snails pace, and most traders were just making educated guesses. That is where we can find ourselves today with Kalshi and Polymarket—and if you know where to look it’ll be like getting in on the ground floor of the NYSE in 1792.

These prediction markets are so novel that you can easily find mispriced contracts if you’re willing to do the legwork. Professional quant shop algorithms haven’t fully arrived yet. The NYSE has evolved into one of the world’s most efficient markets where billions of dollars and thousands of Harvard PhDs compete over a modicum of alpha, all while prediction markets are still in that infancy phase where a motivated trader doing solid research can easily beat the crowd. Finding the edge in these markets is still time consuming—on my profitable trades I’m spending at least 60 to 90 minutes on research atop running it through my machine learning algo.

I plan on sharing future research where I have spotted criminally underpriced contracts after back-testing them in my own proprietary algorithm and machine learning system. I plan on releasing this intelligence to both free and paid subscribers, with paid subscribers getting significantly more insight, and on more contracts.

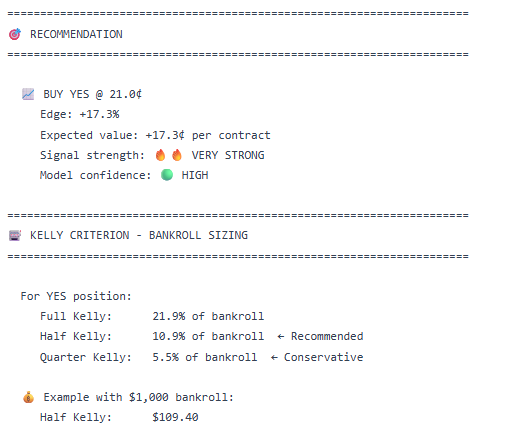

My recommendations will be complete with the Kelly Criterion so you don’t bet the farm. If you’re interested in receiving this level of market intelligence subscribe, so you don’t miss it!

What Are Event Contracts?

Event contracts are financial instruments that settle based on the outcome of a future event. Unlike traditional securities that derive value from company performance, event contracts are tied to direct, verifiable occurrences: Will x candidate win an election? What will the inflation print be? Will a movie make over $100 million in its premier weekend?

Typically, event contracts trade between $0.01 and $0.99 (or $0 and $100, depending on the platform), with the price representing the market’s implied probability of the event occurring. A contract trading at $0.65 suggests the market believes there’s a 65% chance the event will happen. If the event occurs, the contract pays $1; if it doesn’t, it pays $0.

How it works —

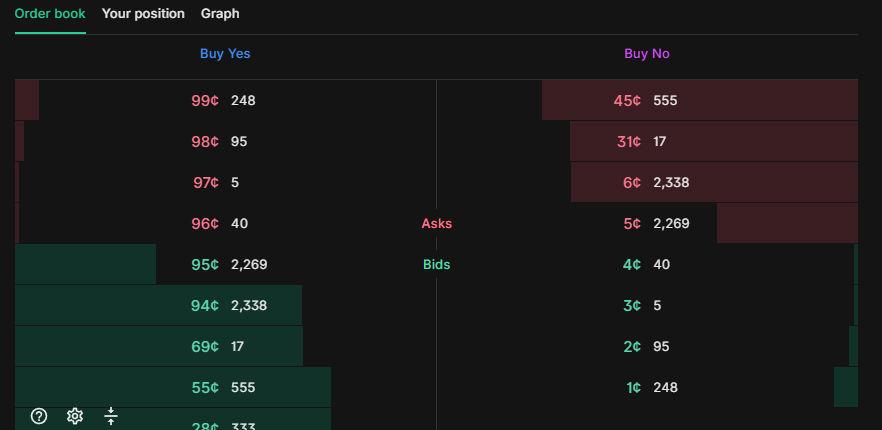

Event contracts function through continuous double-sided-auction markets, similar to stock exchanges. There’s an order book where buyers and sellers submit bid/ask orders, and trades execute when prices match. Market makers often provide liquidity, ensuring you can enter or exit positions without moving the market significantly. They make money off the bid-ask spread such as they do in traditional equity markets.

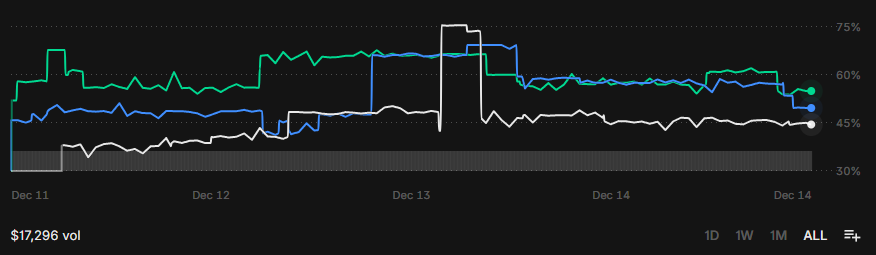

What makes event contracts particularly interesting is their self-correcting nature. When a contract’s price diverges from the true probability of an event, skilled traders can profit by buying the mispricing. In theory this should push prices toward accuracy over time, making prediction markets more often than not effective forecasting tools.

However, this efficiency varies dramatically across markets. Well-established markets with high liquidity(pictured above) and numerous informed participants tend to be quite efficient. Illiquid, emerging markets, by contrast, often contain significant inefficiencies—and that’s where the opportunities lie.

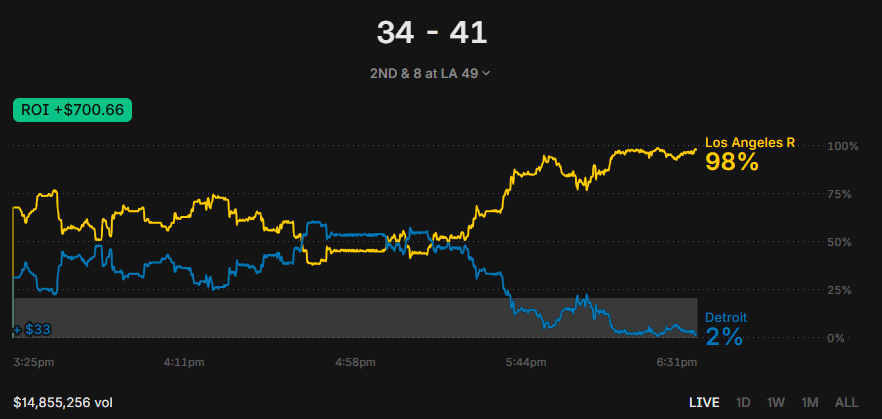

Even highly liquid markets are often times mispriced — take for example a team with a three touch-down lead in the fourth quarter. I found a 6% edge in this scenario just the other weekend. My machine learning stated the team had a 96% chance of winning, while the WIN-YES contracted was trading at a mere 90c (or 90% chance.)

Why Emerging Markets Matter —

Emerging markets in the prediction space are those with limited liquidity, fewer participants, or novel event types that haven’t been extensively traded before. These markets are gold mines for skilled traders because they haven’t yet been picked over by high frequency algorithms.

Consider the difference between betting on a presidential election versus a municipal ballot measure in a mid-sized city. The presidential race will attract thousands of informed traders, political analysts, and substantial capital. The municipal measure might only interest a handful of local residents and political junkies. The presidential market will likely be quite efficient; the municipal market could be wildly mispriced.

Strategies

Information Asymmetry Exploitation

The most straightforward strategy in these emerging event markets is leveraging information advantages. This doesn’t mean insider trading or accessing non-public information it means doing research that other market participants haven’t done.

For a contract on whether a specific legislation will pass, you might read the actual bill, understand the committee composition, track procedural requirements, and follow relevant legislators on social media. Most casual traders will rely on news headlines or superficial analysis. Deeper understanding creates an edge. I have seen this first hand in the comment sections of some contracts where “traders” are only doing one to two weeks of back research.

Early Market Entry

Emerging markets are often most inefficient when they first open. Initial prices may be set somewhat arbitrarily, and early trading volumes are low. Savvy traders who spot these markets quickly can establish positions before efficiency sets in.

This requires monitoring new market listings across platforms and being prepared to act decisively. When you spot a newly listed contract where you have insight or can quickly develop an informed view, early entry can capture value before the crowd arrives. I am presently working on a notification bot, which will notify you when new markets post. Again, this will be a perk for paid subscribers.

Contrarian Positioning in Narrative-Driven Markets

Emerging markets are particularly susceptible to narrative-driven mispricing. When a compelling story takes hold, prices can overshoot rational probability estimates. This creates opportunities for contrarian traders willing to bet against the crowd.

Imagine a contract on whether a hyped startup will reach a billion-dollar valuation within a year. Media coverage might create euphoria, pushing the contract price to $0.85. But a sober analysis of venture funding trends, the company’s actual metrics, and comparable cases might suggest the true probability is closer to 40%. The contrarian takes the “no” side of that bet.

This strategy requires emotional discipline. You’re betting against what “everyone knows,” which feels uncomfortable. But markets often confuse compelling narratives with probable outcomes, especially in emerging spaces where participants lack historical reference points.

Correlation and Portfolio Approaches

Sophisticated traders in emerging event markets don’t just bet on individual contracts—they construct portfolios that exploit correlations between events. If Contract A and Contract B both pay out in similar scenarios but are priced as if they’re independent, you can structure positions to profit from this mispricing. I plan on also using my machine learning system to create ‘baskets’ of contracts with significant edges.

For example, contracts on “Company X will launch Product Y in Q1” and “Company X will report strong Q1 earnings” are clearly correlated. If the first contract is trading high but the second is trading low, there may be an arbitrage opportunity. This is admittedly hard to find as Kalshi as market makers aggressively buy these contracts up.

Building these portfolios requires thinking probabilistically and understanding how different events relate to each other. It’s more complex than simple binary bets, but the rewards can be substantial in markets where these relationships aren’t yet priced in.

Managing Risk in Emerging Markets

The flip side of opportunity is risk, and emerging event markets carry several unique hazards. Liquidity risk is real and you may not be able to get a fill on your positions. Resolution risk exists when there’s ambiguity about how a contract should settle. You must CAREFULLY read the resolution rules of the market you’re trading in. And of course, there’s fundamental risk that your analysis is simply wrong.

Position sizing is your primary defense. Never bet so much on an emerging market that you can’t afford to lose the entire position. Diversification across multiple uncorrelated events helps manage overall portfolio risk. And always understand the resolution criteria before entering a position—nothing’s worse than being “right” about an outcome but losing because the contract settles on a technicality you didn’t anticipate. If you read the comments of contracts on Kalshi you’ll notice most traders aren’t even reading the rules.

Looking forward —

As prediction markets mature and regulatory frameworks evolve, we’re likely to see an explosion of new event types and markets. Climate metrics, AI milestones, space exploration achievements, and countless other domains will spawn tradable contracts. Each new category represents an emerging market with potential inefficiencies to exploit.

The traders who develop systematic approaches to identifying and analyzing these opportunities—who build knowledge in specific domains and learn to spot mispricing patterns—will have sustained advantages as the ecosystem grows.

Again, I plan on starting a series where I will start identifying these mispriced markets based on my own proprietary algorithm and machine learning system.

The best (legal) broker in the U.S. is Kalshi. Use my referral code and we’ll both get 10 dollars! If you can’t afford a subscription, but still find this research possible please sign up with my referral link:

https://kalshi.com/sign-up/?referral=cad6157a-053e-4ad0-8051-caf6ed0f06f9

THIS IS NOT INVESTMENT ADVICE

THE CONTENTS OF THIS ARTICLE DO NOT CONSTITUTE INVESTMENT ADVICE, AN OFFER, SOLICITATION, OR RECOMMENDATION TO BUY OR SELL ANY SECURITIES OR FINANCIAL INSTRUMENTS WHATSOEVER.

All information provided hereto is for informational and educational purposes only and reflects solely the author’s personal views as of the stated publication date. The information has not been tailored to the individual circumstances, investment objectives, or financial condition of any reader, and should not be relied upon as the basis for any investment, trading, or other financial decision.

Readers are expressly advised to undertake their own independent research and consult with appropriate licensed financial, legal, tax, and/or investment professionals before engaging in any securities or financial transactions. Neither the author nor this publication, nor any of their affiliates, agents, or representatives, accept any liability whatsoever for any direct, indirect, or consequential losses arising from the use of this content or reliance on any opinions stated herein. Neither the author nor this publication act in an advisory, fiduciary, or professional capacity to any party by virtue of distributing this material.

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. THE INFORMATION CONTAINED HEREIN IS PROVIDED “AS IS” WITHOUT WARRANTY OF ANY KIND.

THIS IS NOT INVESTMENT ADVICE