Monroe’s Tower of Glass: Dividend Cuts, Rising Overhead, and MV Realty Allegations Facing MRCC Shareholders

A First Strike investigation into how Monroe Capital’s office move, higher occupancy costs, and exposure to MV Realty litigation may be reshaping MRCC’s risk–return profile for shareholders.

OVERVIEW

Monroe Capital Corporation (NASDAQ: MRCC 0.00%↑ ) is a publicly traded business development company (”BDC”) headquartered in Chicago, Illinois. The company operates as an externally managed, non-diversified closed-end investment fund that has elected to be regulated as a BDC under the Investment Company Act of 1940.

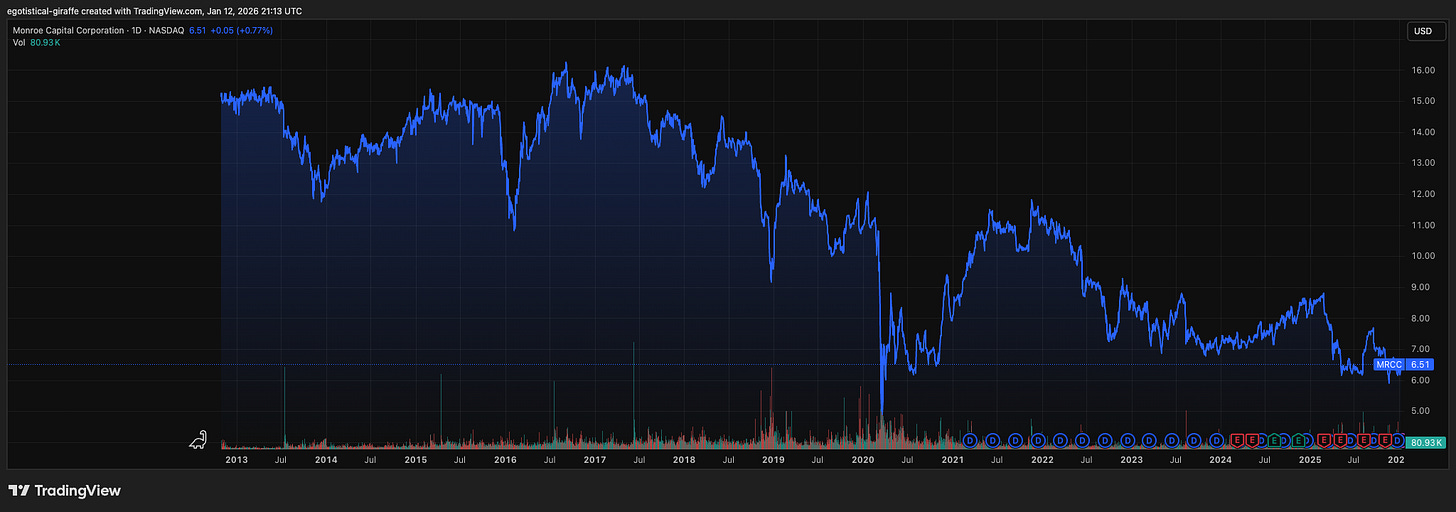

Over the last several years, Monroe’s share price has retreated significantly from a COVID era high of $11.67 (Nov 2021) a share, and Monroe’s cash return to shareholders has subsequently been halved —

Historical dividend: $0.35 per share quarterly (annualized $1.40)

Current dividend: $0.18 per share quarterly (annualized $0.72)

Total reduction: 48.6% decline in the annualized dividend rate

In our research, MRCC has exhibited a recurring pattern of deal structuring and pre‑closing diligence that, in our view, has at times left certain MRCC portfolio companies more highly levered and operationally sensitive than is prudent, which increases the risk of companies not being able to service their debt. We further believe these risks may be compounded by forecasting and expense decisions that appear inconsistent with a period of tightening credit conditions and reduced shareholder distributions, including the company’s premium office footprint and related build‑out spending

Based on a review of public filings and court documents, First Strike Investigators identified four principal concerns:

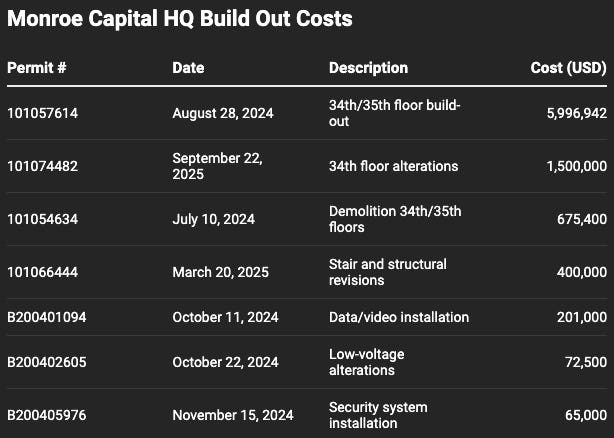

Nearly $9 million in premium office construction during sustained dividend cuts

A $40 million credit facility to MV Realty, now subject to a federal class action alleging Monroe financed a predatory scheme affecting 38,000 homeowners;

A $22.4 million loan to The Worth Collection that a bankruptcy trustee seeks to avoid as an alleged fraudulent transfer.

Exposure to Lifted Trucks, a specialty vehicle lender facing consumer protection scrutiny.

And—as a bonus, First Strike Investigators called a MRCC loan portfolio company, Lifted Trucks, while posing as a subprime borrower to understand downstream risk profiles and to assess the ability of MRCC’s portfolio companies to service their own obligations as MRCC’s debtors.

Not withstanding—we’ve continuously uncovered a pattern at Monroe Capital Corporation that turns middle‑market credit into what we believe to be a risk transfer machine with an inordinate burden placed on investors.

While giving due consideration to the pending NAV‑for‑NAV merger with Horizon Technology Finance Corporation, in which MRCC shareholders are expected to receive HRZN ( HRZN 0.00%↑ ) shares based on relative net asset values (incld. Monroe’s) and to own roughly 37% of the combined company, we believe MRCC’s management may face incentives that are not fully aligned with either current MRCC shareholders or existing Horizon shareholders.

Because the merger consideration is tied to MRCC’s reported NAV, any upward pressure on reported asset values or understatement of indirect corporate costs could, in theory, support a higher effective claim on the combined company’s equity for MRCC holders, and thus increase the dilution experienced by existing Horizon holders.

Bear in mind — we are not alleging that MRCC has misstated its NAV or violated accounting rules; rather, we highlight these structural incentives as a potential governance risk that investors in both companies should evaluate independently.

REQUIRED DISCLOSURE: This report presents a short-biased investment thesis. The author DOES NOT hold short positions in MRCC securities and DOES NOT stand to benefit from a decline in share price. All information herein is derived from publicly available sources including SEC filings, federal court documents, bankruptcy proceedings, and municipal records. Allegations from pending litigation are unproven; defendants have denied liability. This is not investment advice. Conduct independent due diligence.

THESIS

Based on a review of public filings and court documents, Monroe Capital Corporation presents material risks that, in our assessment, are not fully reflected in current market pricing:

New Office Build-Out During Dividend Cuts $8.9M in permit-documented construction costs

MV Realty Class Action $40M credit facility to alleged predatory scheme 38,000 potential class members

Worth Collection Bankruptcy $23M loan subject to fraudulent transfer claims

Dividend Deterioration 48.6% reduction from historical levels (company disclosures)

CAPITAL MISALLOCATION: THE 155 N. WACKER BUILD-OUT

Monroe Capital relocated its Chicago headquarters from 311 South Wacker Drive to 155 North Wacker Drive in early 2025, expanding its footprint by approximately 38% to 40,000 square feet across more than one and a half floors. The move is notable because their original office at 311 South Wacker is itself a Class A, LEED Gold-certified trophy tower—a 65-story landmark that was once the world's tallest reinforced concrete building, featuring a 12,000 square-foot conference center, 7,600 square-foot fitness center, and the iconic illuminated crown visible across Chicago's skyline.

First Strike Investigators found no evidence of building deficiencies or lease disputes that would necessitate departure from 311 South Wacker (above) rather, Monroe's broker characterized the move as seeking "a trophy asset that offered improved access to in-building and neighborhood amenities."

The decision to expand premium office space by 38% while simultaneously cutting shareholder dividends by 48.6% raises questions about management's capital allocation priorities.

Additionally, First Strike contacted MRCC Investor Relations to posit several relocation questions—MRCC did not respond for comment. The following questions were presented to MRCC Management via Electronic Mail

As such, we further direct the following questions to MRCC management:

In light of the Company’s contracting asset base and declining net asset value, what rationale supported the Board’s decision to relocate to a premium “Trophy Class” facility specifically located at 155 N Wacker Dr 35th Floor, Chicago, IL 60606 while simultaneously expanding the corporate footprint by approximately 60%?

What specific cost mitigation initiatives, if any, has management undertaken at the 155 N. Wacker location to offset the estimated $1.45 million annual rent increase and protect shareholder interests?

Findings

Monroe Capital occupied approximately 25,000 square feet at 311 S Wacker. Based on comparable market data for Class B/C office space in Chicago's West Loop submarket, estimated lease rates ranged from $30 to $38 per square foot.

Estimated Annual Occupancy Cost (Prior Location):

25,000 sq. ft. × $34/sq. ft. (midpoint) = $850,000 Monroe Capital executed a lease for approximately 40,000 square feet at 155 N. Wacker Drive, a 48-story commercial tower developed by the John Buck Company in 2009. The property is classified as "Trophy Class"

Based on publicly available commercial real estate data for Trophy Class properties in Chicago's central business district, estimated lease rates range from $50 to $65 per square foot.

Estimated Annual Occupancy Cost (Current Location):

40,000 sq. ft. × $57.50/sq. ft. (midpoint) = $2,300,000 Permit Evidence

Moreover, First Strike Investigators obtained and reviewed City of Chicago building permit records which document Monroe Capital Investment Holdings, L.P. expended $8,910,942 constructing premium office space at 155 North Wacker Drive during a period of sustained dividend reductions and NAV contraction.

The following permits were filed with the City of Chicago Department of Buildings and are independently verifiable:

These expenditures occurred while:

Quarterly dividend fell from $0.35 to $0.18 per share (48.6% reduction)

NAV per share declined materially (company-reported)

The company faced mounting litigation exposure and regulatory scrutiny

The build-out features a custom connecting staircase between floors and operable partition systems—amenities inconsistent with cost discipline expected during periods of financial stress.

The above image is the custom staircase constructed at Monroe Capital. Generally speaking, this is a very costly project in commercial real estate as it requires significant labor, and permitting. Moreover, Monroe Capital made this renovation on a leased property.

Implication

Standard asset management practice dictates that overhead costs should decline proportionally—or at accelerated rates—during periods of revenue contraction to preserve operating margins. The evidence we presented above indicates MRCC's management pursued the inverse approach: increasing fixed costs while revenue declined.

Management elected to allocate nearly $9 million to premium office construction while simultaneously reducing shareholder distributions by approximately $14.6 million annually, based on the dividend cut across the share base. This capital allocation decision warrants scrutiny with respect to management alignment and governance.

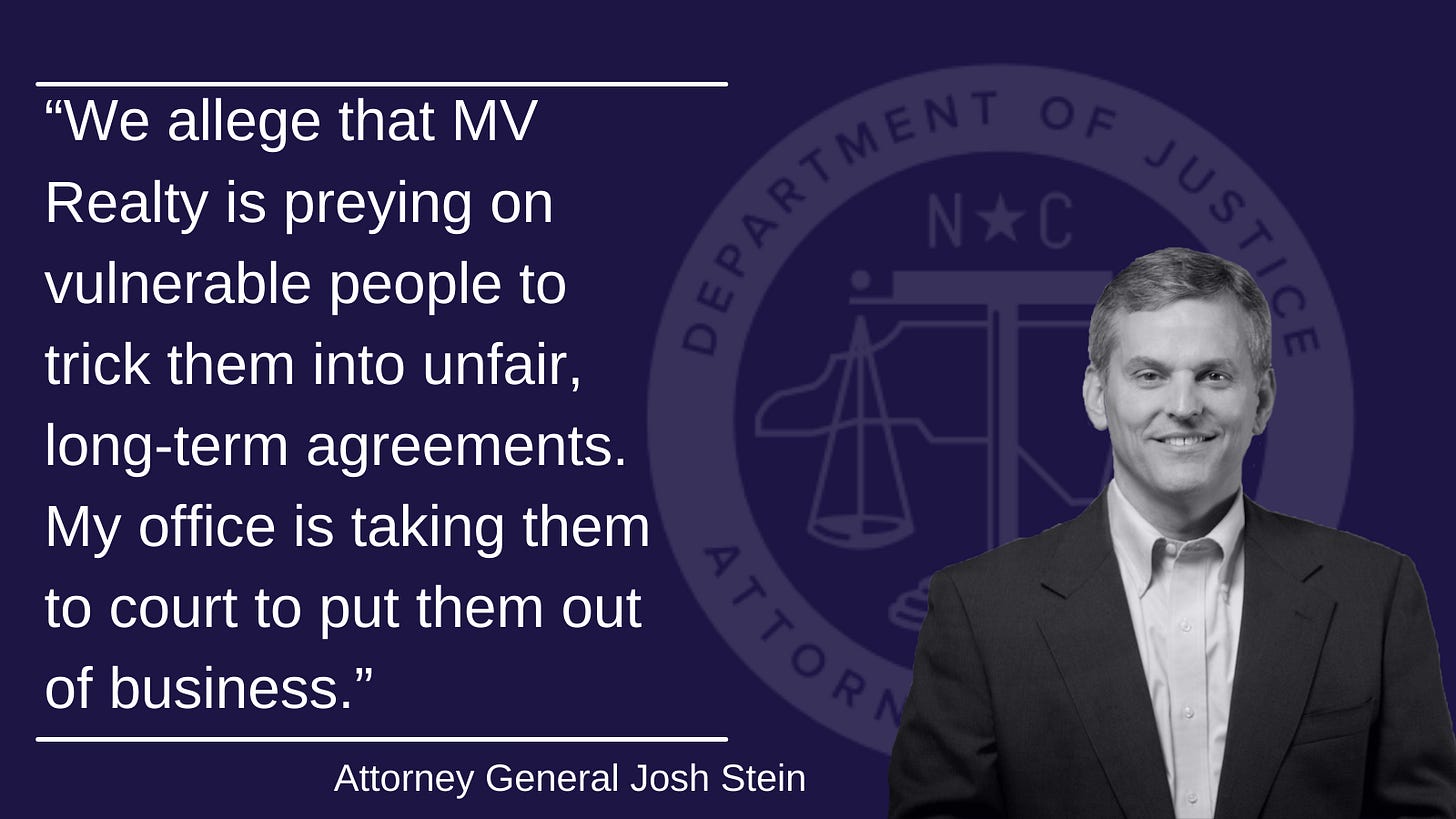

MONROE ALLEGEDLY FINANCED A PREDATORY LENDING SCHEME

Case Reference

Keller v. Monroe Capital Corporation, No. 1:25-cv-02474-SAG (D. Md.)

Status: Motion to Dismiss pending

Potential Class Size: ~38,000 homeowners

Monroe Credit Facility Amount: $40 million

Legal sections are drawn from publicly available court filings and other public records. These allegations are unproven, and all defendants, including Monroe Capital Corporation and its affiliates, have denied liability. Any characterizations of conduct or incentives reflect the author’s opinions based on those materials and are not statements of fact about anyone’s actual intent or legal liability. Nothing herein should be interpreted as legal advice or as a conclusion that any contract or practice is unlawful; such determinations rest with courts and regulators.

The Alleged Scheme: Overview

According to the complaint, the alleged action arises from:

“a fraudulent and predatory scheme initially designed by MV Realty PBC, LLC and financed, strategically directed, and monetized by Monroe Capital.“

The complaint alleges Monroe Capital was not a passive lender but an active strategic partner that enabled MV Realty to scale from operating in a handful of states to 33 states nationwide.

The Homeowner Benefit Agreement

We examined the complaint’s detailed description of the HBA structure, which plaintiffs characterize as a predatory financial instrument disguised as a real estate listing agreement.

What Consumers Were Told

According to the complaint, MV Realty’s marketing materials promised “risk-free cash” with “no obligation to return the payment” and “no obligation to sell.” Telemarketers positioned the HBA as “better than a loan“ because it required no credit check and, they claimed, no repayment. What consumers received appeared modest: a cash payment typically ranging from $300 to $1,000, averaging approximately 0.03% of their home’s value.

For a family struggling with bills, facing an unexpected expense, or simply seeking a financial cushion, this upfront cash appeared harmless.

What Consumers Actually Signed

The complaint describes a dramatically different reality:

A 40-Year Exclusive Listing Agreement: The HBA bound not only the homeowner but their heirs for four decades—a contractual term that would follow families across generations.

A Recorded Encumbrance on Their Property: The complaint states MV Realty would, “within 48 hours of signing the HBA, record the agreement in the state land records.” This recorded memorandum functioned, as plaintiffs allege, as a lien—clouding the property’s title and preventing homeowners from refinancing, accessing equity, or selling without MV Realty’s involvement.

A 3% Termination Penalty: To escape the agreement, homeowners faced a termination fee of 3% of their home’s value—a payment that typically exceeded the original cash advance by a factor of ten or more.

The Alleged Economic Reality

The complaint provides this calculation:

“If a homeowner receives $500 for signing the HBA and sells the home five years later for $250,000, they owe MV Realty $7,500—a 1,400% return on the original payment.“

The complaint articulates the true purpose of this structure:

“The true purpose of the HBA was to so completely frustrate the homeowner that they capitulated and paid an onerous penalty to terminate the HBA. This ‘termination fee’ was typically 3% of the home’s value, making it at least ten times the amount of MV Realty’s upfront cash payment.“

Despite repeated assurances that the HBA was “not a loan,” the complaint alleges that “for all functional purposes, the HBA Scheme functioned as a predatory high interest loan.“

Monroe Capital’s Alleged Knowledge

The complaint cites a May 28, 2021 due diligence document titled “MV Receivables II, LLC New Business Presentation” allegedly authored by Monroe Capital BDC Advisors, LLC. First Strike Investigators consider this 39-page document central to understanding Monroe’s alleged awareness of the scheme’s mechanics.

On the extraordinary returns:

“MV Realty earns an internal rate of return of 150% on an HBA.”

On the lien mechanism:

“[I]mportantly, the FLC (referring to an HBA), is recorded on the home title... so the homeowners are unable to sell the homes with clean title without paying MV[R] its commissions.“

On industry classification:

The presentation lists MV Receivables II as operating in the “banking and finance“ industry—not real estate.

On exit strategies:

Exit strategies discussed include “Portfolio Securitization“ and “Sale of the Company“—treating homeowner obligations not as real estate service contracts but as financial instruments to be packaged and monetized.

The complaint alleges this presentation demonstrates Monroe Capital’s awareness of the coercive and deceptive aspects of the HBA scheme and that it acted in furtherance of that scheme.

Revenue Structure: The 77% Termination Fee Finding

First Strike Investigators consider this statistic among the most significant in the complaint. The complaint cites an investigation by the Georgia Attorney General:

“Between January 2021 and December 2022, early termination fees accounted for 77% of all ‘harvests’“ in that period.

The complaint states this percentage was representative nationwide, implying MV Realty’s business model depended on penalty extraction rather than brokerage services.

When more than three-quarters of revenue derives from consumers paying to escape contracts rather than from the stated service, questions arise regarding the legitimacy of the underlying business model—and the due diligence conducted by Monroe.

Monroe’s Alleged Profit Share

According to the complaint, Monroe Capital’s financial stake in the “harvests” from homeowners escalated over time:

Year 1: MV retained harvest revenues but had to substitute new HBAs as collateral.

Year 2: Monroe Capital allegedly received 50% of all harvest proceeds.

After Year 2: Monroe Capital allegedly received 100% of harvest proceeds, including from earlier portfolios.

The complaint alleges Monroe’s financial gains extended to MV Realty’s existing portfolio, including agreements secured through prior marketing practices.

Employee Testimony: Todd Schneider

The complaint references testimony from Todd Schneider, a former MV Realty agent and team leader, in the Indiana Attorney General enforcement action.

On Monroe’s control over valuation:

“Schneider states valuation rules were dictated or directed by Monroe’s investor requirements.”

On Monroe’s influence over consumer-facing terms:

“Schneider also testified that MV Realty reduced homeowner payments when interest rates rose in order to satisfy Monroe Capital’s investment return expectations, demonstrating Monroe Capital’s influence and control over consumer-facing contract terms.”

On securitization:

“According to Mr. Schneider, Monroe Capital not only funded the program but also participated in securitizing the HBA contracts and selling them to third parties, transforming future termination fee obligations into financial products.”

First Strike Investigators consider this testimony significant: if credited and sustained, it suggests Monroe’s influence extended to the very terms offered to consumers at the point of sale.

Monroe’s Alleged Operational Control

The complaint cites contractual arrangements that plaintiffs argue demonstrate operational involvement beyond passive lending:

Board Observation Rights (Section 6.07 of the Equity Purchase Agreement):

“...observation rights at all Board of Directors meetings of the Company (or any committee thereof)... the Agent [Monroe], at its option, shall be permitted to have a designee attend in-person or via telephone for sessions covering matters relating to the Company’s business including... operational details (including financial performance, operations, credit, and collection and servicing); [and] legal and regulatory updates...”

The Backup Servicing Agreement:

“Provides that ‘the lender,’ defined as Monroe, must approve the assignment of backup brokers“

“Grants Monroe Capital (as lender) the power to act directly in place of MV Realty, including the right to assign or remove backup brokers”

“Gives Monroe Capital access to transactional records, listing agreements, and broker communications for properties secured by HBAs”

Expansion Approval:

“On information and belief, Monroe Capital’s financing agreements required MV Realty to obtain approval before entering new markets, particularly because Monroe’s valuation and risk models were tied to enforceability of the liens and harvest rate projections in each state.”

Defendant’s Position (Motion to Dismiss)

Monroe Capital’s motion to dismiss characterizes its role as that of a passive lender not alleged to have directly engaged in fraud:

“Plaintiffs allege MV Realty defrauded them into entering illegal contracts. Rather than sue MV Realty, they sue Monroe, a lender to MV Realty. But Monroe itself is not alleged to have actually engaged in any fraud, and, as a lender, Monroe is not responsible for MV Realty’s actions.“

Monroe frames its contractual protections as “garden-variety creditor protections” and “normal incidents of a borrower-lender relationship.”

First Strike Investigators note the tension between this characterization and the allegations regarding Monroe’s due diligence documentation acknowledging 150% IRRs, board observation rights, backup servicing authority, expansion approval requirements, and profit-sharing arrangements with escalating percentages of “harvest” proceeds. Please bear in mind, again, all information provided above is alleged.

WORTH COLLECTION

Case Reference

Tabachnik v. Monroe Capital Management Advisors, LLC, Adv. Proc. No. 23-50321-BLS (Bankr. D. Del.)

Status: Litigation ongoing

Monroe’s financing of The Worth Collection is a clear example of aggressive deal structuring that appears to prioritize shareholder cash-outs over the company’s ability to survive. The Chapter 7 trustee alleges that Monroe helped fund a leveraged buyout that put more than $25 million of debt on Worth while leaving the company with only about $1 million of operating cash, effectively making it insolvent at closing.

According to the complaint, most of the money went to selling shareholders rather than into the business, while Worth’s interest expense exploded and the company swung from profit before the deal to losses afterward, defaulting on covenants within a year and liquidating by 2020. Worth is asking the court to unwind Monroe’s $22.4 million loan, strip its liens, and even recharacterize its supposed “debt” as equity—remedies normally reserved for conduct viewed as abusive or inconsistent with arms‑length lending.

Viewed alongside other regulatory and litigation matters involving Monroe’s risk and disclosure practices, this transaction can be presented as part of a broader pattern: deals that maximize leverage, rely on optimistic projections, and expose both borrowers and Monroe’s own investors to undue downside, raising serious questions about Monroe’s underwriting discipline and risk culture.

DOWNSTREAM CREDIT ANALYSIS

First Strike Investigators utilized open source intelligence collection methods to surmise Monroe’s exposure to downstream credit risk. First Strike chose one of Monroe’s largest portfolio companies for analysis:

Lifted Trucks Holdings, LLC, is an Arizona‑based used truck dealership group specializing in customized lifted pickups and SUVs.

Monroe entered the Lifted Trucks facility in August 2021, committing a senior secured term loan and revolver maturing in 2027. In 2021, used‑vehicle pricing and dealer profitability were still inflated by stimulus, supply constraints, and ultra‑low rates, but the tightening cycle and affordability reversal were already visible in the macro backdrop.

Rather than building in a margin of safety, Monroe chose to lend long‑dated capital at double‑digit yields to a business model whose demand and credit quality are acutely sensitive to rising rates and normalization in used‑vehicle values.

As of the March 31, 2024 10‑Q, MRCC’s exposure consisted of:

Senior secured term loan:

Principal: approximately $6.843 million

All‑in interest: about 11.18% (SOFR + 5.85%)

Maturity: August 2, 2027

Fair value: $6.702 million (very close to par)

Revolving credit facility:

Funded balance: about $0.889 million

Fair value: $0.871 million

Combined, Monroe had roughly $7.6 million of funded exposure to Lifted Trucks, representing around 3.8–4.0% of MRCC’s net assets at that time.

Put simply, this is one of MRCC’s larger single‑name positions, and the loan is still carried near 100 cents on the dollar despite a weakening used‑vehicle and subprime credit backdrop.

A First Strike Investigator contacted a Lifted Trucks sales manager by phone in January 2026, and posed as a prospective buyer with a stressed credit profile to test how aggressively the dealership is using leverage to drive sales.

First Strike imitated the following buyer persona:

FICO score “around 600“ after the past year.

Recent charged‑off credit cards, with only “repayment plans” in place.

Self‑reported income of $100,000 per year.

Looking for a truck in the $80,000 price range.

Manager’s response on approval odds:

The manager said he could get the buyer approved “without a worry” given the $100k income, despite the charged‑off cards.

He volunteered that he has seen customers with credit scores as low as ~450 obtain financing.

He went on to volunteer that their finance department is one of the best in the country at closing deals and getting buyers behind the wheel.

He indicated the only profiles he routinely sees declined are borrowers with prior foreclosures or repossessions, implying that almost anything short of that can be pushed through a lender.

Subjectively speaking, the sales manager sounded very “buyer friendly” which could lead conjecture towards muted sales.

This conversation suggests Lifted Trucks is actively steering even heavily distressed credit profiles into auto loans, likely via a mix of local credit unions and specialized lenders that “work with them,” enabling high loan‑to‑value structures for subprime low‑FICO borrowers. Such behavior is consistent with late‑cycle dealerships that rely on increasingly risky customers to keep unit volume and gross profit high as affordability deteriorates and used‑vehicle pricing normalizes.

The above is consistent with a dealership increasingly dependent on near‑ and deep‑subprime financing to sustain unit volume into a deteriorating auto credit cycle, not with the kind of resilient, through‑the‑cycle cash flow profile implied by Monroe’s near‑par valuation of the loan.

For MRCC, this creates a tension between the 11%+ yield it collects on the senior secured facility and the rising embedded default risk at the dealership level. If delinquencies and charge‑offs spike among Lifted Trucks’ customer base, the borrower’s ability to service Monroe’s loan could erode far faster than the near‑par fair value marks currently imply.

We believe Monroe does not have the ability to accurately forecast macro/micro economic trends before exposing investors to downstream credit risk as evidenced by Monroe’s Lifted Trucks underwriting which can be best understood as a late‑cycle, pro‑cyclical bet that has aged poorly under even basic stress testing and forward economic modeling.

Read our next article on MRCC’s holdings here:

IMPORTANT DISCLOSURES & DISCLAIMER (READ CAREFULLY)

This publication is provided for general informational and educational purposes only and reflects the author’s opinions as of the date of publication, which are subject to change without notice. Nothing herein is, or should be construed as, investment advice, legal advice, accounting advice, tax advice, or a recommendation or solicitation to buy, sell, or hold any security or other financial instrument; readers should consult their own licensed professionals and conduct independent due diligence.

All statements of fact are intended to be drawn from publicly available materials believed to be reliable at the time of writing (including, where cited, SEC filings, court pleadings, motions, bankruptcy dockets, press releases, news reporting, and municipal/public records). To the extent this publication quotes, summarizes, or characterizes allegations from lawsuits, administrative proceedings, regulatory actions, or other disputes, such allegations are unproven unless and until established by a final adjudication, and the defendants deny wrongdoing as reflected in the cited record.

Any references to “fraud,” “scheme,” “predatory,” “coercive,” “usurious,” “improper,” “misconduct,” “incompetence,” or similar terms are used, if at all, only as shorthand for allegations described in cited proceedings or as non-literal rhetorical or analytical commentary, and not as a statement of proven criminal or civil liability. Readers should not interpret any discussion of incentives, motive, intent, knowledge, control, or causation as a factual assertion of any person’s state of mind; such discussion reflects the author’s opinion and inference based on the public record cited.

Estimates, projections, scenarios, and forward-looking statements (including those regarding valuation, rent/lease economics, NAV implications, merger outcomes, portfolio performance, credit metrics, or “risk”) are inherently uncertain and may differ materially from actual results; such statements are provided for illustrative purposes only. Numerical figures may be rounded, derived, or modeled and could contain errors; readers are encouraged to verify all figures independently.

The author and publisher disclaim any duty to update this publication. By reading this publication, you agree that the author and publisher shall not be liable for any losses, damages, or claims arising from the use of, reliance on, or inability to use the information hereto.

Positions / conflicts: The author’s positions (if any) may change at any time, including before or after publication, without notice. Unless expressly stated otherwise in this publication, the author does not hold any fiduciary relationship with readers.

As part of routine investigative due diligence, First Strike Investigators may contact companies and other market participants to evaluate publicly observable business practices, customer-facing representations, and operational risk indicators. Any such outreach is intended solely to understand general processes, stated underwriting criteria, and downstream risk profiles, and is not intended to obtain non-public information, to interfere with any business relationship, or to induce reliance by the contacted party.

Contact: outreach@firststrike.trading