The fall of Caesars Palace

Like the Roman Empire, CZR finds itself in similar peril.

Caesars Entertainment (CZR🔻–39.13%) YTD

The “owner” of Caesar’s Palace Las Vegas, Caesars Entertainment (hereafter CZR), was recently booted off the S&P 500. That event motivated me to start this series on the company’s struggles and possible paths management can take to deliver shareholder value. This first article covers CZR’s sports gaming offerings and explains why a spin-off could save the brand and motivate investors.

The Empire Owes All

In an ironic twist, the gambling operator is levered to its ears in costly debt. CZR is encumbered by about $25 billion in total debt, with net debt (after accounting for cash) in the $24–25 billion range—over six times the company’s entire market capitalization. CZR’s annual interest expense alone is nearly $2.4 billion, and its debt-to-equity ratio often exceeds 600%, which is extremely high even for a capital-intensive sector.

To put it in perspective: If CZR were an individual, they would make $100,000 per year but have maxed out over $600,000 in credit card debt. Each year, they pay $24,000 in interest just to keep creditors at bay, leaving almost nothing to pay down principal.

History repeating itself

CZR finds itself in a predicament reminiscent of the late Roman Empire—burdened by massive public and private debts while continuing to produce spectacle. CZR orchestrates entertainment and gaming on a grand scale, renting its coliseums and incurring staggering debt to keep the show going.

This leaves CZR exposed to heavy rent payments without the benefit of real asset ownership. As a result, CZR is left holding the bag on all operating costs and upgrades, leading to a mix of aging, under-renovated casinos, mounting competition, and declining margins. Its digital sports betting segment shows promise but still lags far behind industry leaders. With shares down more than 38% in 2025 and trading over 50% below prior highs, CZR’s asset-light structure and debt load leave it struggling to compete with digital disruptors and well-capitalized rivals.

How a Caesars Sports Spinoff Could Save The Empire

CZR trades at a valuation disconnect that creates an extraordinary shareholder opportunity. Its $4.17 billion market cap ($20.45 per share) is demonstrably less than what its digital sports betting and iGaming segment alone might fetch as a standalone operation. Separating Caesars’ digital business from its mature, cash-intensive casinos could create $27.7 billion in new shareholder value—potentially 663.5% upside—by allowing each business to be valued on more appropriate multiples.

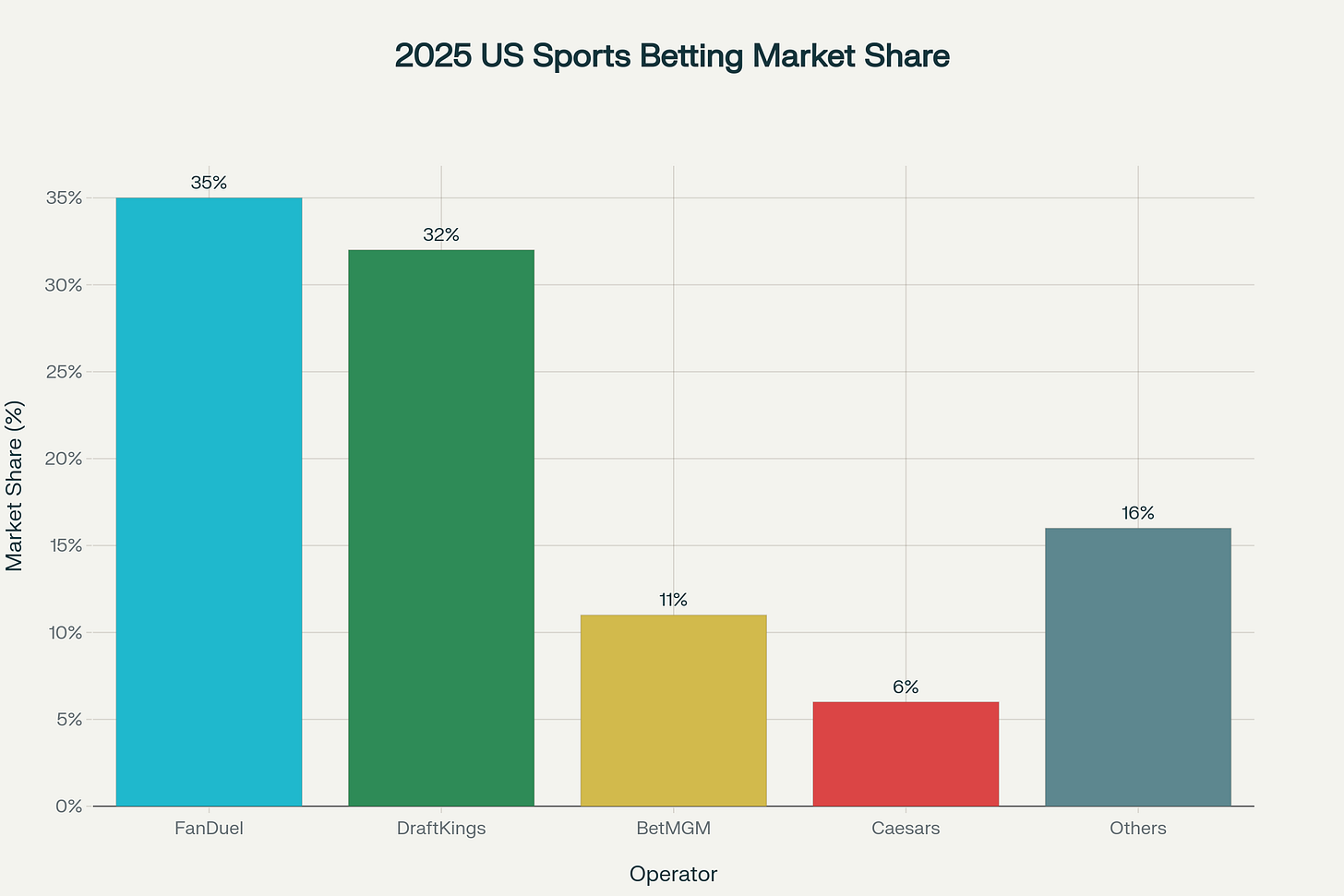

The brutal economics divergence between digital and brick-and-mortar gaming is driving this. Rapid expansion of legal sports betting has allowed digital-only platforms like FanDuel (35% market share) and DraftKings (32%) to dominate the space while avoiding the debt and overhead that plagues CZR’s physical casinos.

Caesars Digital (CZR’s online/sports betting arm) generated $1.2 billion in 2024 revenue and turned profitable in late 2022 after $1.1 billion in accumulated losses. The segment hit $117 million in adjusted EBITDA for 2024, with Q2 2025 delivering $80 million (100% year-over-year growth). iGaming revenue jumped 60% in 2024, and management projects $500 million in EBITDA by 2026.

These results could justify a $5.3–$7.5 billion valuation for Caesars Digital if valued standalone at 15x–22x EBITDA, but inside the consolidated structure, a crushing $11.29 billion net debt and deteriorating physical assets obscure the true potential.

CZR’s Struggle For Market Share

American sports betting is almost completely dominated by “digital first” operators. FanDuel holds 35% of gross gaming revenue, and DraftKings controls 32%, giving them a near 67% duopoly. BetMGM—a similar brick-and-mortar operator which operates Vegas properties such as the Aria, MGM, NewYork-NewYork - captures 11%, respectively. Despite CZR’s similarly large casino footprint, it only manages 6% market share. This is in part based on several factors that were outside of CZR’s control. Both DraftKings and FanDuel began as daily fantasy services. Once sports betting was legalized, DraftKings and FanDuel leveraged the agility afforded to digital-first platforms to quickly launch operations as soon as states legalized betting. In turn, CZR’s dual mandate of juggling brick-and-mortar casinos and online sports betting has forced them to fight off their backfoot.

Spinning Off The Empire

Digital-first operators trade at higher multiples than integrated casino firms:

DraftKings trades at 22x 2025 EBITDA.

Flutter (FanDuel parent) at 18–22x.

Average: 19.2x EBITDA.

By contrast, diversified casino operators like Caesars trade at 6–12x EBITDA. Caesars’ $4.17 billion market cap and $29.07 billion enterprise value translate to just 7.8x LTM EBITDA. If Caesars Digital was valued at 15x consensus 2025 EBITDA ($352M), the implied valuation is $5.28 billion ($25.87 per share), or 26.5% upside from current levels.

Management’s Spinoff Consideration

On the Q4 2024 earnings call CZR management has even acknowledged the need to consider all avenues to maximize digital value:

“If the market dynamics remain the same, and the business continues to grow as it has, you should expect that we would look at any and all avenues in terms of how we can drive the most value.”

Tom Reeg, CEO, Caesars Entertainment

If CZR spun off its sports/iGaming division, the new entity could operate independently, leveraging Caesar’s brand recognition. The parent could streamline operations in its remaining casinos.

In the next article in this series, I’ll go deeper into what a digital only spinoff scenario could look like for Caesars.